During a recent electronics show my attention was drawn by a strange small orange device on display at the Freescale booth. It turned out to be the Kinetis KwikStik and a very enthusiastic Freescale employee immediately showed me its features and explained that it was fully compatible with the Tower system, Freescale�s reconfigurable development platform, but it can also be used stand-alone. When I asked for a KwikStik to review, no problem, he would send me one after the show. Only five days later (including a weekend) I received the kit.

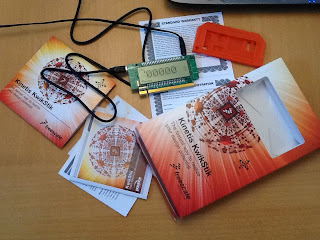

The KwikStik comes packed in a nice box and you can see that Freescale has spent some time and effort to deliver an attractive product. In the box you will find a KwikStik in its bizarre orange silicone jacket, a DVD, a USB cable and some instructions. Included also is a warranty card, the first one I get with a dev kit. If the kit is broken, you can send it back.

Looking closely at the KwikStik you may notice the logo of Pounce Consulting in several places. Looking up this company on the internet you will find an electronics outsourcing company that probably did this kit for Freescale.

The box promises �

the fastest way to realize your design potential�. Now that got me interested as this seemed to be a great candidate for the MCU dev kit benchmark that I presented in a previous post.

When you open the booklet you will see two photographs of the board with arrows indicating its special features. There are many: an LCD, a microphone, a micro USB socket (two actually, the other is for the Segger J-Link connection), an audio output, a buzzer, six touch buttons, a micro SD socket, a battery, an IrDA port, a switch, extension connectors (one as a PCI-like edge connector), and, almost forgot to mention it, a Kinetis K40X256VLQ100 ARM Cortex-M4 MCU. This 100 MHz hot rod sports 512 KB Flash memory, 64 KB RAM and 4 KB EEPROM. A large range of integrated peripherals is available and since it is Cortex-M4 based, it also has an additional 32-bit integer DSP (which is completely ignored in the K40 Sub-Family Reference Manual).

On the next two pages of the booklet information is provided about the demo software preloaded on the kit and also step-by-step installation instructions. Step 1 is connecting the board to the PC to power it. Step 2 is navigating through the demo applications. Step 3: select an application, step 4 go to the Freescale web site. Strange. Nothing to install? I mean, what about the DVD? Next page of the booklet: J-Link and additional features. Last page: nothing.

Oh? OK. Well, let�s do step one: connect the board to the PC. Windows detects the board without any problems and I see the text �KWIKSTIK� scrolling from right to left, hear a beep and then see �LFT� followed by �RGT�, then �SEL.� (with dot) and finally scrolling again �SOUND RECORDER�. Pushing the touch pads is not very reliable and results in a kind of random behaviour, I don�t feel that I have any control over what is happening. So I remove the board from its silicon jacket and this makes things somewhat better. I can now navigate a bit easier, but it is still not very reliable.

The options available are Sound recorder, Remote control, USB mouse and Fretris. Trying the sound recorder I manage to record 2 seconds of data. The recording played back over headphones is barely audible and hidden by some loud interfering sound. I cannot try the remote control because I do not have a Sony TV. The USB mouse suddenly makes me understand the acronyms LFT, RGT & SEL. Why on earth didn�t they write it out? The display is large enough. Anyway, the USB mouse doesn�t work very well. Pressing LFT does random things on my PC like jumping to the left or selecting a block of text, the RGT pad opens the context menu. Actually LFT seems to do a double or triple left mouse button click; RGT does a mere single right mouse button click. Finally, Fretris is a simple Tetris game that is very hard to control as the touch pads do not work well.

The Kinetis KwikStik indicates all by itself its helloWorld score. It is even more severe than I am.So, then, what�s on the DVD? Well, a flash animation that let�s you click some links to open documents or install software. Included on the DVD are Freescale�s MQX RTOS (free), IAR�s Embedded Workbench for ARM (30-day evaluation and a 32 KB limited kickstart edition), Green Hills� Multi IDE and Keil�s MDK for Freescale Kinetis (32 KB limited edition). Other tools (Segger, CodeWarrior, etc.) are available on-line. Unfortunately, there are no instructions on what you should do next.

At random I pick Green Hills� Multi IDE. Wrong choice. You have to unzip this, and then install 1 GB before getting tangled in a license request net. In the world of fastest ways to realize your design potential this is very bad and results in an immediate uninstall. Unfortunately there is no uninstall provided for this package, which makes it even worse. Let�s hope deleting the folder is enough to get rid of this stuff. Probably not, because a dongle driver was installed too.

[24 hours later: I am still waiting for an evaluation license from Green Hills.]

[Monday 19 December, a week later: I finally received a message from Green Hills about my licence request. More questions, but still no evaluation license. How intimate do you have to be with this company before they let you have a glance at their products? This sure takes the pace out of the fastest way to realize my design potential.]

Because I do not give up easily, I now try the IAR EW 32 KB kickstart edition. First, get a license by filling in a form and answering all kinds of questions. Contrary to Green Hills license delivery is immediate. Then install 2 GB of tools to discover that no examples are included for the KwikStik. I have now reached the point of saturation and give up.

After two hours of fiddling with the hardware, installing software and filling in license request forms I am still not able to flash an LED on the board. I haven�t even addressed the J-Link needed to program the board for which separate drivers have to be installed from some conveniently unspecified location. The fastest way to realize your design potential, yeah right. What a bummer. The KwikStik receives an helloWorld score of 1. You cannot get any lower than 1 because I will always give 1 to compensate for the time & effort to design, build and send me the kit.

It is really a shame to see how all the effort to design a nice and fun looking kit with an extremely powerful MCU is annihilated by a total lack of interest for the end user. Is it really that difficult to add a few lines of instructions to help the user on his way? Many hours went in the design of this board but apparently the budget was used when the DVD still had to be done.

DisclaimerThe reviewed board may be great once you get the tools set-up correctly, but being an impatient person I did not manage to get that far. I have other things to do too.

Although the ad was meant to tickle your bone, the protagonists here being projected as sort of idiots is sad for the brand. In pursuit of humor, the brand forgotten what it wants to convey with respect to brand persona.

Although the ad was meant to tickle your bone, the protagonists here being projected as sort of idiots is sad for the brand. In pursuit of humor, the brand forgotten what it wants to convey with respect to brand persona.